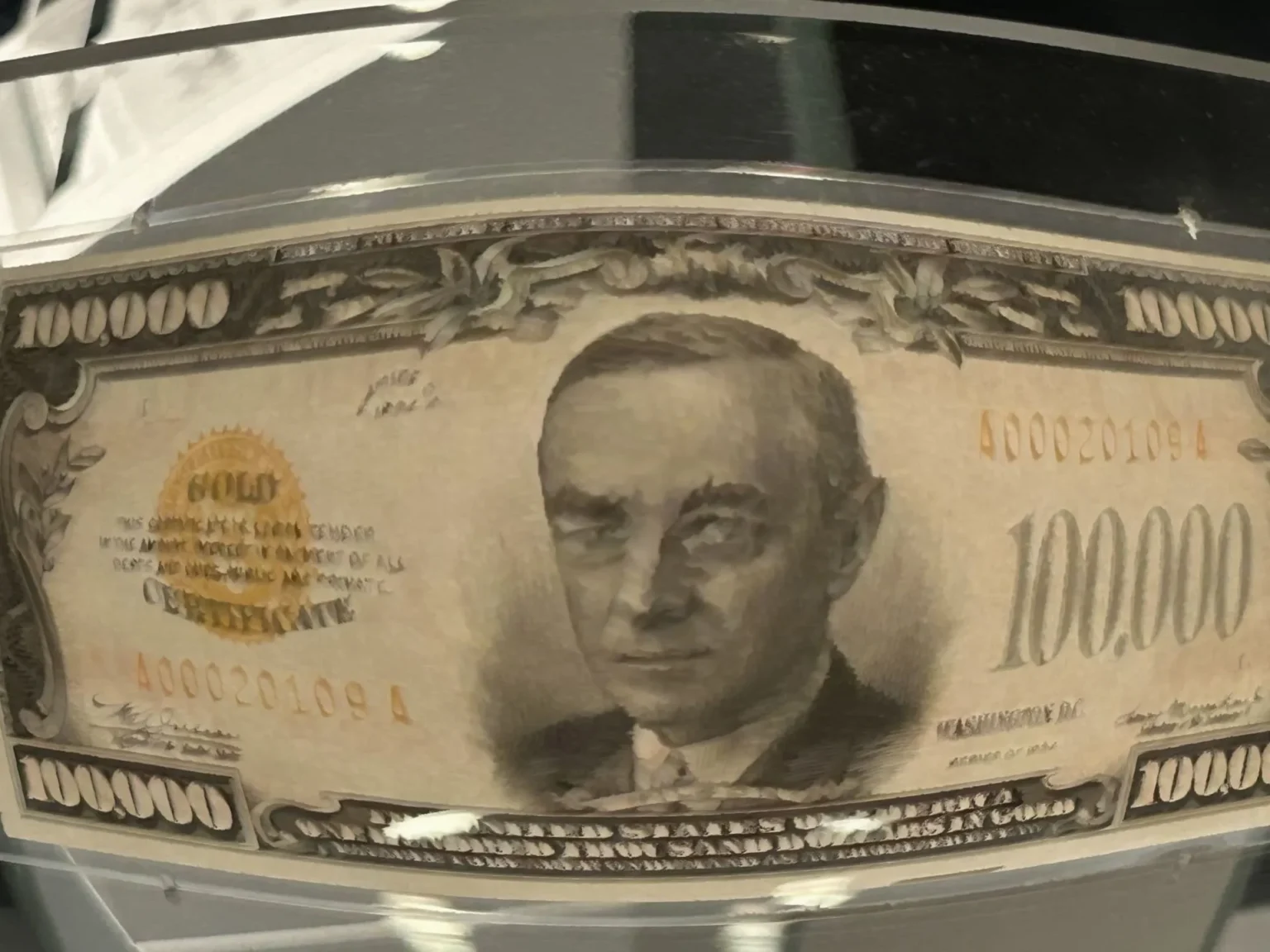

Bitcoin has achieved a monumental milestone, surpassing $100,000 for the first time and edging closer to a $2 trillion market capitalization. This historic surge cements Bitcoin’s position as a transformative force in the global financial ecosystem, rivaling the valuations of some of the world’s largest companies.

Key Drivers of Bitcoin’s Record-Breaking Rally

1. Spot Bitcoin ETFs Open Doors for Investors

The introduction of U.S.-based spot Bitcoin exchange-traded funds (ETFs) has been a game-changer for institutional adoption. Launched by financial powerhouses like BlackRock and Fidelity earlier this year, these ETFs have rapidly attracted approximately $30 billion in assets under management. By offering a regulated and straightforward way to invest in Bitcoin, these products have significantly increased demand.

2. Political Tailwinds Fuel Confidence

The recent election of a crypto-supportive U.S. president has created a favorable regulatory environment, reigniting enthusiasm in the cryptocurrency market. This political shift eased investor concerns, sparking renewed momentum that propelled Bitcoin from $73,500 in March to its recent historic high.

Corporate Adoption Boosts Bitcoin’s Growth

Corporate interest in Bitcoin has played a pivotal role in driving demand.

- MicroStrategy Leads the Way: Since 2020, MicroStrategy has accumulated 386,700 Bitcoin tokens, now valued at over $38 billion. The company’s aggressive Bitcoin strategy has inspired other firms to explore similar approaches.

- Broader Corporate Interest: Companies across various sectors are considering Bitcoin for their treasury strategies, signaling growing confidence in the asset’s long-term value. Even major tech corporations are reportedly weighing Bitcoin as part of their financial strategies.

Bitcoin’s Market Cap: A New Benchmark

At nearly $2 trillion, Bitcoin’s market value is comparable to some of the world’s most valuable companies:

- Tech Industry Giants: Apple and Nvidia are valued at approximately $3.5 trillion, with Microsoft close behind at $3 trillion.

- Gold’s Legacy: Bitcoin’s market cap is steadily approaching the $17.7 trillion valuation of all gold globally, further solidifying its status as “digital gold.”

This achievement highlights Bitcoin’s evolution from a niche investment to a mainstream financial asset with global influence.

The Path Forward

Bitcoin’s rise to $100,000 is more than a financial milestone—it’s a testament to the growing acceptance of decentralized digital assets. With institutional investments surging, corporate adoption expanding, and a supportive regulatory backdrop, Bitcoin is well-positioned for further growth.

As the crypto market matures, Bitcoin’s role as a transformative asset will continue to shape the future of finance. While challenges may arise, this milestone reaffirms Bitcoin’s resilience and its potential to redefine global economics. The journey ahead promises innovation, growth, and a continued shift toward a decentralized financial world.