Ethereum (ETH) exchange-traded funds (ETFs) are making headlines with a record-breaking $333 million in daily inflows, signaling a major shift in investor sentiment. For the first time, ETH ETFs outpaced Bitcoin (BTC) funds, cementing Ethereum’s role as the “catch-up trade” of the current market cycle.

Ethereum ETFs Lead with Record-Breaking Performance

Friday marked a significant milestone for Ethereum ETFs as they recorded their highest single-day inflows ever. Data from Farside Investors reveals that nine ETH products collectively pulled in $332.9 million during the shortened U.S. trading session.

- BlackRock’s iShares Ethereum Trust (ETHA) led the charge, attracting a massive $250 million.

- Fidelity’s Ethereum Fund (FETH) secured $79 million in fresh investments.

This performance extended ETH ETFs’ streak to five consecutive days of net inflows and capped off the second-best week ever with $455 million in total inflows, despite markets being closed for Thanksgiving Thursday.

Ethereum Outpaces Bitcoin in ETF Flows and Market Gains

Ethereum ETFs didn’t just lead in inflows—ETH also outperformed Bitcoin in price action:

- Spot Bitcoin ETFs gathered $320 million on Friday but faced weekly net outflows.

- Ethereum Price Gains: ETH climbed above $3,700 on Saturday, marking a five-month high and showcasing stronger growth relative to BTC over weekly and monthly periods.

This recent performance highlights Ethereum’s ability to reclaim investor interest after months of lagging behind Bitcoin.

Why Ethereum Is the Top “Catch-Up Trade”

Ethereum’s rising momentum has sparked discussions among analysts, with many calling it the “most obvious catch-up trade” of the current cycle. After underperforming Bitcoin for much of the year, several factors are now aligning in ETH’s favor:

1. Growing Optimism for Decentralized Finance (DeFi)

Ethereum remains the backbone of the DeFi ecosystem, and an improved outlook for DeFi has renewed investor confidence in the network.

2. Favorable Regulatory Climate in the U.S.

With a new administration on the horizon, expectations of a warmer regulatory environment are boosting optimism for Ethereum-based investments, particularly ETFs.

3. Record Institutional Interest

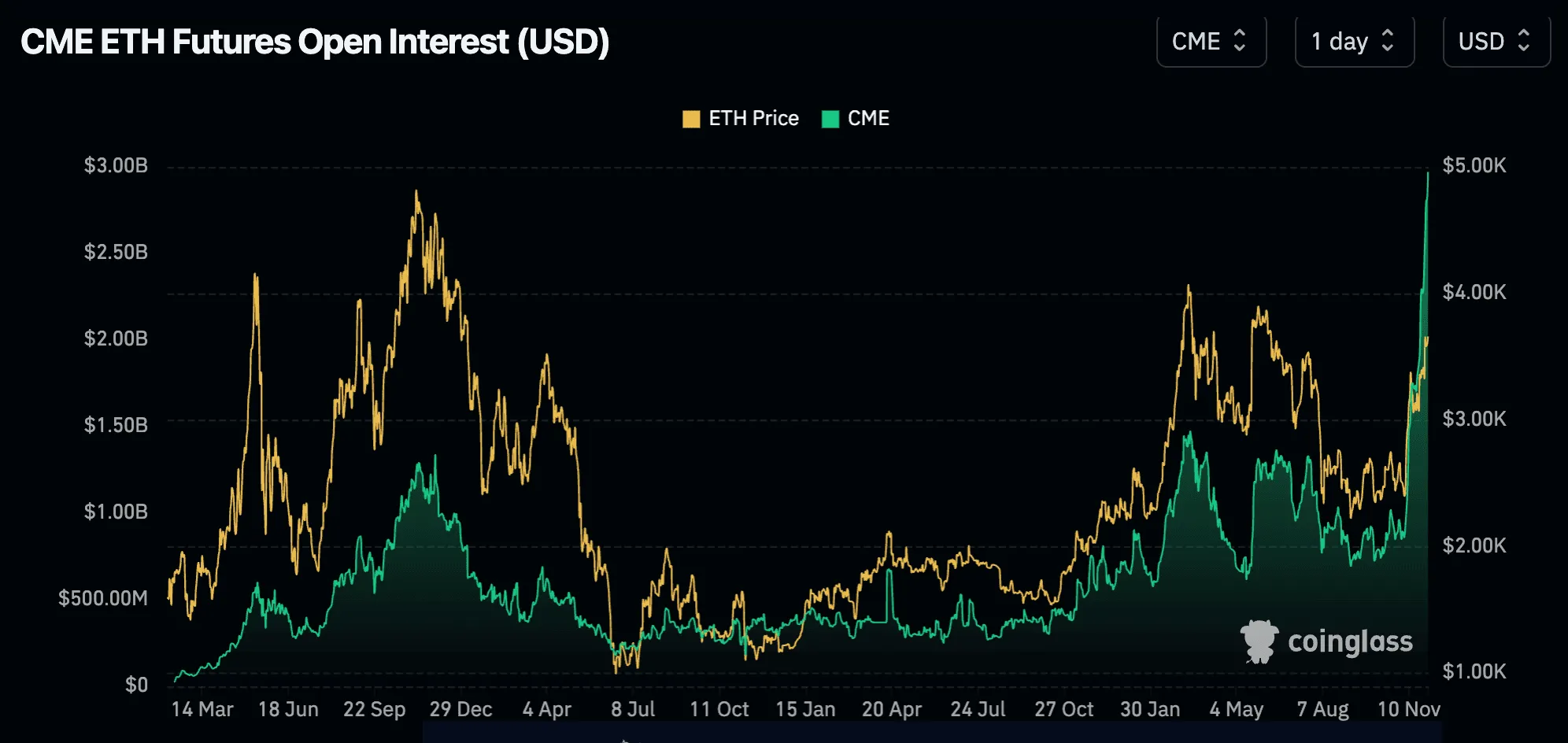

Institutional investors are showing increasing interest in Ethereum. Open interest for ETH futures on the CME reached a new all-time high of nearly $3 billion, as reported by CoinGlass. This signals strong institutional demand and a shift toward ETH as a long-term opportunity.

ETH-BTC Ratio Signals a Potential Trend Reversal

Analysts suggest that the ETH-BTC ratio could be forming a long-term bottom. The ratio has been declining for nearly three years but now shows signs of reversal.

Joel Kruger, a strategist at LMAX Group, explained that improving market conditions and investor optimism surrounding DeFi are critical drivers behind this shift.

“We believe the better outlook for DeFi, coupled with a more accommodating regulatory environment, is pushing investors to reconsider Ethereum as a key player in the crypto space,” said Kruger.

Final Thoughts: Ethereum Poised for Growth

Ethereum’s record-breaking ETF inflows, combined with rising institutional interest and stronger price performance, underscore its growing importance in the cryptocurrency market. The recent outperformance against Bitcoin and the renewed focus on DeFi have positioned ETH as the go-to investment for traders seeking growth opportunities.

With ETH surpassing $3,700 and gaining ground in ETF flows, the momentum suggests that Ethereum is entering a new phase of strength. Investors are increasingly viewing ETH as a promising contender for continued growth, potentially narrowing the gap with Bitcoin in the coming months.